A savings account is among the easiest and safest places to keep your money. It’s also among the most effective strategies for gradually increasing wealth. You can earn interest, keep your money separate, and see your balance increase with a savings account. It can be used to save for your child’s education, an emergency fund, or a trip.

We’ll go over the definition of a savings account, its operation, its significance, and how to pick the best one for you in this guide.

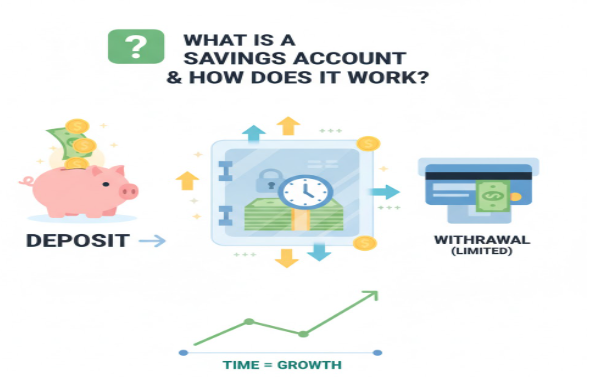

What is a savings account?

An account at a bank or credit union that allows you to save money over time while earning interest is called a savings account. A savings account differs from a checking account in that you are not required to spend the funds immediately.

- To put it simply, this is how it operates:

- You fund your savings account.

- Interest is paid when you keep your money in a bank or credit union.

Although most accounts don’t allow it very often, you can withdraw your money whenever you need to.

To put it briefly, a savings account compensates you for keeping your money secure while the bank lends it out or makes an investment elsewhere.

How Does a Savings Account Work?

There are a few simple rules that govern savings accounts that are good for both you and the bank.

1. Deposits and Withdrawals

There are a few ways to put money into your savings account:

- Directly from your checking account

- Your employer will deposit money directly into your account.

- You can deposit a cheque or cash at a branch or on your phone.

You can take money out by:

- Online transfer

- Withdrawal from an ATM

- Visit your bank in person

But some banks only let you make a certain number of free withdrawals each month (usually six). This makes you want to save instead of spend a lot.

2. Interest and APY (Annual Percentage Yield)

The best thing about a savings account is that you can earn interest on the money you have in it. The Annual Percentage Yield (APY) is the amount of money that banks give you each year.

For example, if your savings account has a 4.00% APY and you leave $1,000 in it for a year, you’ll make about $40 in interest without doing anything.

Interest grows over time, so you also earn interest on the interest you already have. The longer you keep your money and the more you save, the faster it grows.

3. Your bank makes good use of your deposits.

The bank uses the money you put into a savings account, along with other deposits, to make loans for things like mortgages, car loans, and business loans. In return, they pay you interest. This is a good deal for both sides because your money stays safe and makes more money.

4. Security and FDIC/NCUA insurance

FDIC insurance protects U.S. savings accounts in banks, while NCUA insurance protects credit unions.

These organizations protect deposits of up to $250,000 per person and per institution. This means that even if the bank goes out of business, your money is still safe. One of the safest places to keep money is in a savings account.

Types of savings accounts

Different savings accounts are not the same. These are the types that are most common:

1. Regular Savings Account:

- Most brick-and-mortar banks offer this type of account.

- ATMs and branches make it easy to get to.

- Usually lower interest rates, between 0.01% and 0.25% APY.

2. High-Yield Savings Account:

- These accounts are mostly found at online banks.

- Has much higher interest rates (3.00%–5.00% APY in 2025).

- You can get to it through mobile apps or online portals.

- Great for people who are used to handling money online.

3. Money Market Account:

- A mix of a savings and checking account.

- Usually comes with a debit card or limited check-writing rights.

- Higher minimum balance requirements, but APYs that are competitive.

4. Certificate of Deposit (CD)

- This is a type of account where you lock up your money for a set amount of time, like six months or a year.

- You can get more interest than in a regular savings account, but you will have to pay a fee if you take money out early.

5. Savings Account for Kids or Joint Accounts

- Couples can own things together with joint accounts.

- With the help of their parents, kids can learn how to be responsible with money by opening savings accounts.

Why You Should Open a Savings Account

Here’s why almost everyone, from students to retirees, should have at least one savings account:

1. Financial Security

A savings account is like a safety net for your money. It’s where your emergency fund is, ready for medical bills, car repairs, or losing your job.

2. Earn Passive Income

Even a low APY can help your savings grow over time, especially in accounts that pay a lot of interest.

3. Separates spending and saving

Having your savings in a separate account makes it less likely that you’ll spend money on a whim.

4. Helps Reach Goals

You can open more than one savings account for different goals, like going on vacation, making a down payment, or going to school, and keep track of each one separately.

5. Safe and Covered

Your principal in a savings account doesn’t change like it does when you invest. It’s safe and you can always get to it.

How to Open a Savings Account (Step-by-Step)

It’s easy to open a savings account, and you can usually do it online in less than 10 minutes.

- Look at different banks and their rates. Find accounts with competitive APYs, no maintenance fees, and good customer service.

- Get your papers together. You’ll need your ID, proof of address, and your Social Security number.

- You can apply online or in person. Fill out the form and prove who you are.

- Put money in the bank. Most banks require an initial deposit of $25 to $100.

- Set up automatic transfers so that a part of each pay cheque goes into your savings without you having to do anything.

That’s all! You are now officially saving and earning.

Pros and Cons of Savings Accounts

| Pros | Cons |

| Safe and insured up to $250,000 | Lower returns compared to investing |

| Easy access when needed | Withdrawal limits may apply |

| Earns passive interest | Inflation can outpace interest rates |

| Builds financial discipline | Some accounts charge fees for inactivity |

Key Takeaways

- A savings account helps you store money safely while earning interest.

- Your deposits are insured and easily accessible.

- Choosing the right type of savings account (especially a high-yield one) can significantly boost your long-term savings.

- Combine your savings account with good habits like automation and budgeting to maximize results.

Final Thoughts

What Is a Savings Account? A savings account is the first step to financial independence and serves as more than just a location to store money. It assists you in reaching your objectives, managing your finances, and preparing for emergencies.

Whether you’re saving your first $100 or your next $10,000, the most crucial thing is to get started right away. Your money has more time to grow the earlier you begin saving. Additionally, you’ll feel more at ease knowing that it’s secure and effective for you.

FAQs About Savings Accounts

-

How much money should I keep in my savings account?

Aim for at least three to six months of living expenses as an emergency fund.

-

Can I lose money in a savings account?

No — your balance is insured by the FDIC or NCUA up to $250,000.

-

Is a savings account better than investing?

They serve different purposes. Savings accounts are for safety and liquidity, while investments are for growth and involve risk.

-

How often do banks pay interest?

Most banks compound and credit interest monthly.

-

Can I open more than one savings account?

Yes, many people open multiple accounts for different goals (travel fund, emergency fund, etc.).