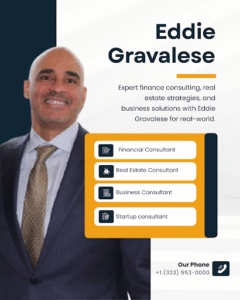

When it comes to financial investments, understanding the different job roles can be confusing. Two common positions you might hear about are finance analysts and finance consultants. While both provide financial guidance, they do so in different ways. In this article, we’ll explain the differences between these roles and highlight the expertise of Eddie Gravalese, a trusted finance and business consultant.

Who is a Finance Analyst?

A financial analyst studies financial data. They consider factors such as sales, expenses, and profits. It is their responsibility to identify patterns and give the company an outline of the way they are performing. To explain their findings, they also make reports and charts. Finance analysts are employed within an individual business. They have expertise in math, Excel, and financial software. They are aimed at assisting the company to make wise financial decisions.

Who is a Finance Consultant?

A finance consultant assists companies in overcoming financial issues. Consultants work with numerous customers, unlike the analysts who normally work within an organization. They can offer suggestions, develop action plans to strengthen financial health. They can, as an example, propose some methods of making savings, investing efficiently, or developing a business.

Eddie Gravalese is also a finance consultant who guides companies to understand their finances and plan for success. The consultants usually work on short-term projects, and they use their experience to advise clients.

Best Skills That Finance Consultants Need

Finance consultants play an important part in assisting businesses to make sound financial decisions. The following are the essential skills that a finance consultant should have:

Key Differences Between Finance Analyst and Finance Consultant

| Aspect | Finance Analyst | Finance Consultant |

| Main Focus | Analyzing financial data | Advising and solving financial issues |

| Work Location | Usually inside one company | Works with multiple clients |

| Interaction | Limited client contact | Works closely with clients |

| Timeframe | Ongoing, daily tasks | Project-based, short or long-term |

| Job Type | Employee | Often self-employed or consulting firm |

| Skills Needed | Data analysis, reporting | Problem-solving, strategy, communication |

When Should You Hire a Finance Consultant?

When a business is struggling with specific challenges and requires expert and strategic decisions, then a finance consultant such as Eddie Gravalese will be valuable. Consultants are very well suited for projects that need an outside perspective, like:

- Reducing costs or improving operational efficiency

- Planning for rapid growth or market expansion

- Navigating complex financial restructuring or mergers

- Implementing new financial systems or compliance measures

- Tackling one-time financial challenges that require specialized expertise

Since consultants are mainly hired for short-term projects, they introduce new thinking, effective strategies, and best practices within an industry, and hence can offer instant responses to urgent problems.

It is also an excellent decision to hire a consultant when a business requires unbiased advice on significant financial decisions or when a company does not have enough resources internally.

When is a Finance Analyst the Right Choice?

A finance analyst plays a critical ongoing role within a company by providing continuous financial tracking and analysis. They focus on:

- Monitoring daily financial data like sales, expenses, and cash flow

- Identifying trends and patterns that affect business performance

- Supporting budgeting, forecasting, and financial planning processes

- Preparing regular reports and dashboards to inform management decisions

- Ensuring the accuracy of financial data and helping optimize resource allocation

The finance analysts are most suitable for organizations that require a specialized person within the group to monitor financial well-being carefully. They allow managers to make proactive decisions and quickly respond to changing market conditions.

How Eddie Gravalese generates Value as a Finance Consultant

Eddie Gravalese is a reliable finance and business consultant who has extensive experience in providing personalized suggestions. He understands the unique financial circumstances and offers tailored solutions for challenges like cash flow, growth planning, and regulatory issues.

- Eddie has the ability to review complicated financial information and identify trends or issues.

- It is important to explain financial information clearly. Eddie Gravalese knows finance terminology and communicates well with clients and teams who might have limited knowledge in the field of finance.

- All businesses encounter unique financial problems. A good consultant like Eddie develops innovative solutions and ways to resolve problems.

- Small inaccuracies in numbers can cause major issues. Eddie is also a pro in scrutinizing reports and forecasting thoroughly.

Eddie has the experience of working across industries, which adds the elements of innovativeness and the ability to communicate effectively to enable any business to make confident predictions based on data. As a partner, he not only plays the role of a consultant but also as a long-term oriented advisor with a long-term loyalty in mind.

Conclusion

The practice of finance analysis and finance consulting work is concerned with money, though in different lights. Analysts only look at information within a firm, but consultants give guidelines to firms as outsiders. Being aware of these differences enables business entities to make decisions on their needs. Whether it is a continuous relationship or you need help on a project where you need the expertise of a person, making the right choices matters. When you need a financial adviser or a business development expert, you may also contact Eddie Gravalese, a finance consultant.